CFDs allow investors to trade the price movement of assets including ETFs, stock indices, and commodity futures. CFDs provide investors with all of the benefits and risks of owning a security without actually owning it. CFDs use leverage allowing investors to put up a small percentage of the trade amount with a broker

When a trader opens a new CFD trade on stocks, the broker opens an identical trade in the underlying stock, which acts as a hedge for the broker. For example, if the client has a long EUR/USD or gold CFD position, the broker owns the corresponding short position, as well as a long position in the stock.

CFDs on stocks are subject to dividend adjustments. When a stock security pays dividends to its shareholders, dividend adjustments will be made to the trading accounts of clients who hold a position on the index at 00:00 GMT+2 time zone (note that DST may apply) on the ex-dividend date. CFDs on Germany30 (GER30Cash) and CFDs on future indices are not subject to dividend adjustments.

Buy trades will receive an amount calculated as follows:

Dividend Adjustment = stock dividend declared x lots x contract size

Sell trades will be charged an amount calculated as follows:

Dividend Adjustment = stock dividend declared x lots x contract size

Trade majors, minors, emerging and exotic currencies from your DSC MT4/MT5 account!

Our proprietary DSC Aggregation engine helps you consistently get the best spreads.

Benefit from the deep liquidity of our pool of top tier liquidity providers to ensure you always get filled at the best rates.

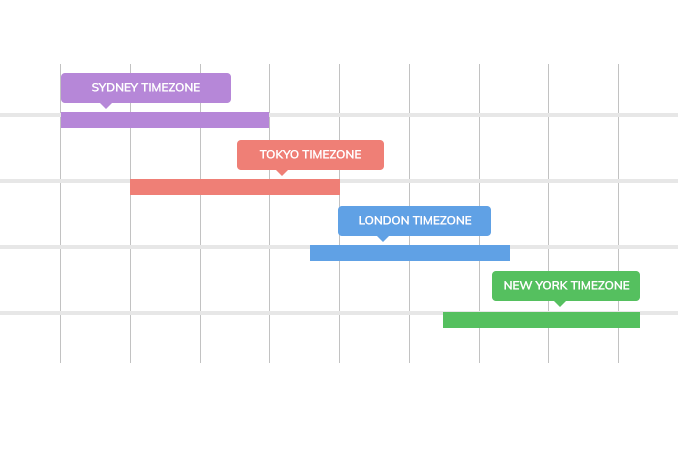

Ensure lightning-speed execution with our strategically located NY4 and TY3 Equinix Servers.

Trade to your maximum potential with high 1:500 leverage

Whether you’re a scalper, news trader or EA trader - DSC provides you the best environment to fulfil your potential.

Never experience a single requote with our deep liquidity pool and lightning execution speeds.

DSC has 2 reputable licenses - ASIC, VFSC. You can rest assured that your funds are safe with us.

When you have nothing to hide

Major currency pairs are made up of the world’s most popular and liquid currencies. They are all traded against the US Dollar and have the tightest spreads in forex trading.

When a currency pair does not include the US Dollar, it is called a minor currency pair or a cross-currency pair.

| Bid | Ask | ||

|---|---|---|---|

| AUDCAD | |||

| AUDCHF | |||

| AUDJPY | |||

| AUDNZD | |||

| CADCHF | |||

| CADJPY | |||

| CHFJPY | |||

| EURAUD | |||

| EURCAD | |||

| EURCHF | |||

| EURGBP | |||

| EURJPY | |||

| EURNZD | |||

| GBPAUD | |||

| GBPCAD | |||

| GBPCHF | |||

| GBPJPY | |||

| GBPNZD | |||

| NZDCAD | |||

| NZDCHF | |||

| NZDJPY |

An exotic currency pair includes a major currency and the currency of a developing economy. These exotic currency pairs are usually less liquid hence having higher spreads.

| Bid | Ask | ||

|---|---|---|---|

| AUDSGD | |||

| EURSGD | |||

| GBPSGD | |||

| NZDSGD | |||

| USDSGD | |||

| SGDJPY | |||

| AUDZAR | |||

| CHFZAR | |||

| EURCZK | |||

| USDCZK | |||

| USDMXN | |||

| USDZAR | |||

| AUDCNH | |||

| EURCNH | |||

| EURHKD | |||

| EURNOK | |||

| EURSEK | |||

| EURTRY | |||

| GBPNOK | |||

| GBPSEK | |||

| NOKSEK | |||

| NZDSEK | |||

| USDCNH | |||

| USDDKK | |||

| USDHKD | |||

| USDNOK | |||

| USDRUB | |||

| USDSEK | |||

| USDTRY | |||

| CHFHUF | |||

| EURHUF | |||

| USDHUF |

Some people believe that becoming a successful trader or investor starts with you acting like a successful person. It takes time, just like defistockchain.com haven gotten so much data over

If you haven’t heard this before then you should probably hear it now; “Stock trading is risky, and you can lose all your money and investment if you don’t have

This training will teach you how to understand stocks trading charts, the various types of stock trading chats and the possibilities of easy trading and profits made possible by defistockchain.com